Guiding you through every step of the journey.

SCP's goal is to fuel your interest in the world of transactions while guiding you in crafting effective strategies to maximize both your qualitative and quantitative objectives.

Majority Recapitalization.

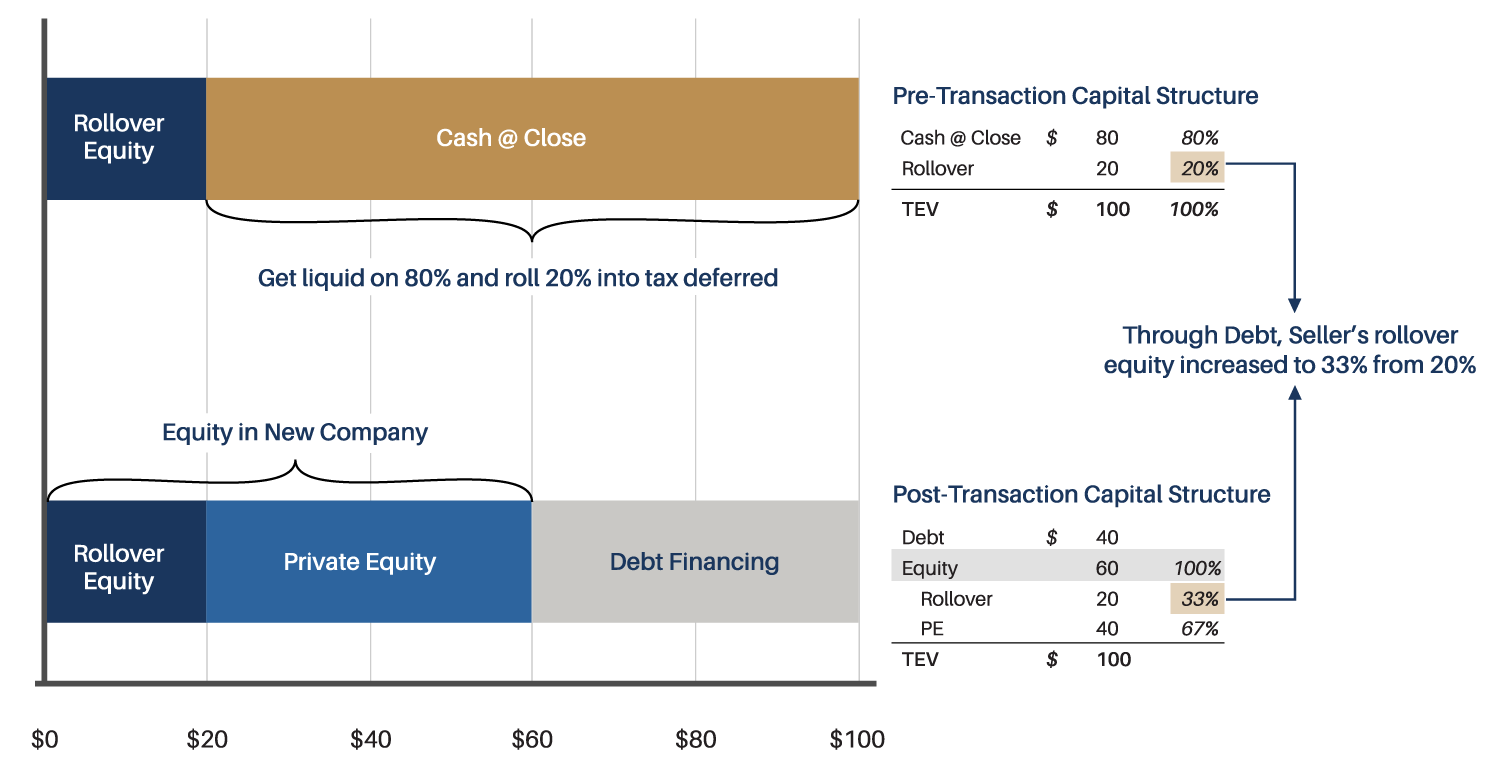

In a majority recapitalization, ownership sells a majority of interest in their company to an investor while maintaining a minority position and continuing to work for the company post transaction. To better illustrate, an owner would like to diversify their net worth and bring on a financial partner to help aggressively grow their business. Ownership is still engaged in the business, recognizes the potential for growth, and would like to maintain a level of exposure to the upside. In this example, the owner chooses to liquidate 80% of their ownership in the company while retaining exposure to 33% of the company moving forward, satisfying both near- and long-term objectives.

Value Creation.

Strong buyers are committed partners, focused on adding value to what you have already created by leveraging their considerable managerial experience, operational knowledge, customer strategies, and industry relationships to help strengthen the growth of your business. With thoughtful acquisitions and a robust, organic growth plan, your business can scale and realize the full upside potential of growth.

1. Proceeds at Close

- At close, the shareholders take out 80% of the EV (subject to tax).

- The shareholders reinvest 20% in the form of rollover equity (tax deferred).

- Together, with a partner and resources, the platform pursues an aggressive growth strategy.

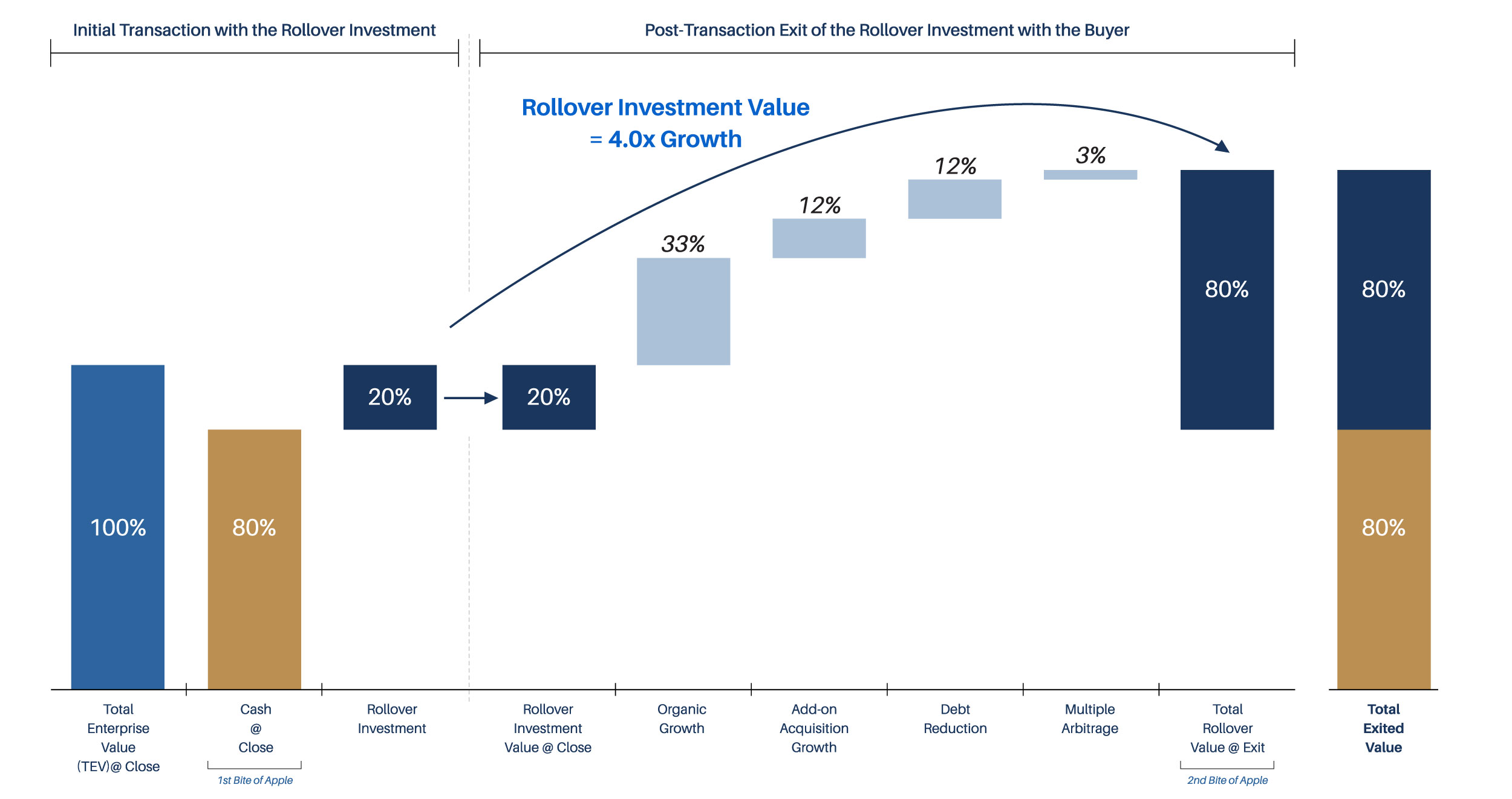

2. Rollover Appreciation

- The company continues to execute the long-term strategic and financial plan.

- Inorganic strategies (add-on acquisitions) accelerate growth and margin expansion.

- Management retains ownership percentage by leveraging lender relationships.

3. Value at Exit

- At exit, the Company has doubled revenue and EBITDA.

- Through the growth process, ownership has retained 33% of the combined business.

- At the end of the hold period, value creation has yielded a total consideration of 160% the original TEV.

Private Equity Buy and Build Model.

What is Private Equity Looking For?

Private equity is seeking platforms with best-in-class leadership and the business platform to serve as the support for a combined organic and inorganic (acquisitive) growth strategy.

How Does Private Equity Partner After the Transaction?

Private Equity does NOT interfere with or run company operations. The existing leadership runs the show. The primary difference is that leadership is now equipped with a resourceful partner that can strengthen the development of the next phase of the business.

How Can Private Equity Help Drive the Growth of the Company?

Additional

Capital

Operational

Excellence

Growth and Margin Expansion

Network of

Experts

Digital

Transformation

Change

Management

Working Together & 100% Focused on Growth.

The Result: A Bigger and Stronger Company.

EBITDA Explained.

In the world of Mergers & Acquisitions, the value of a private Company is typically based on EBITDA.

What is EBITDA?

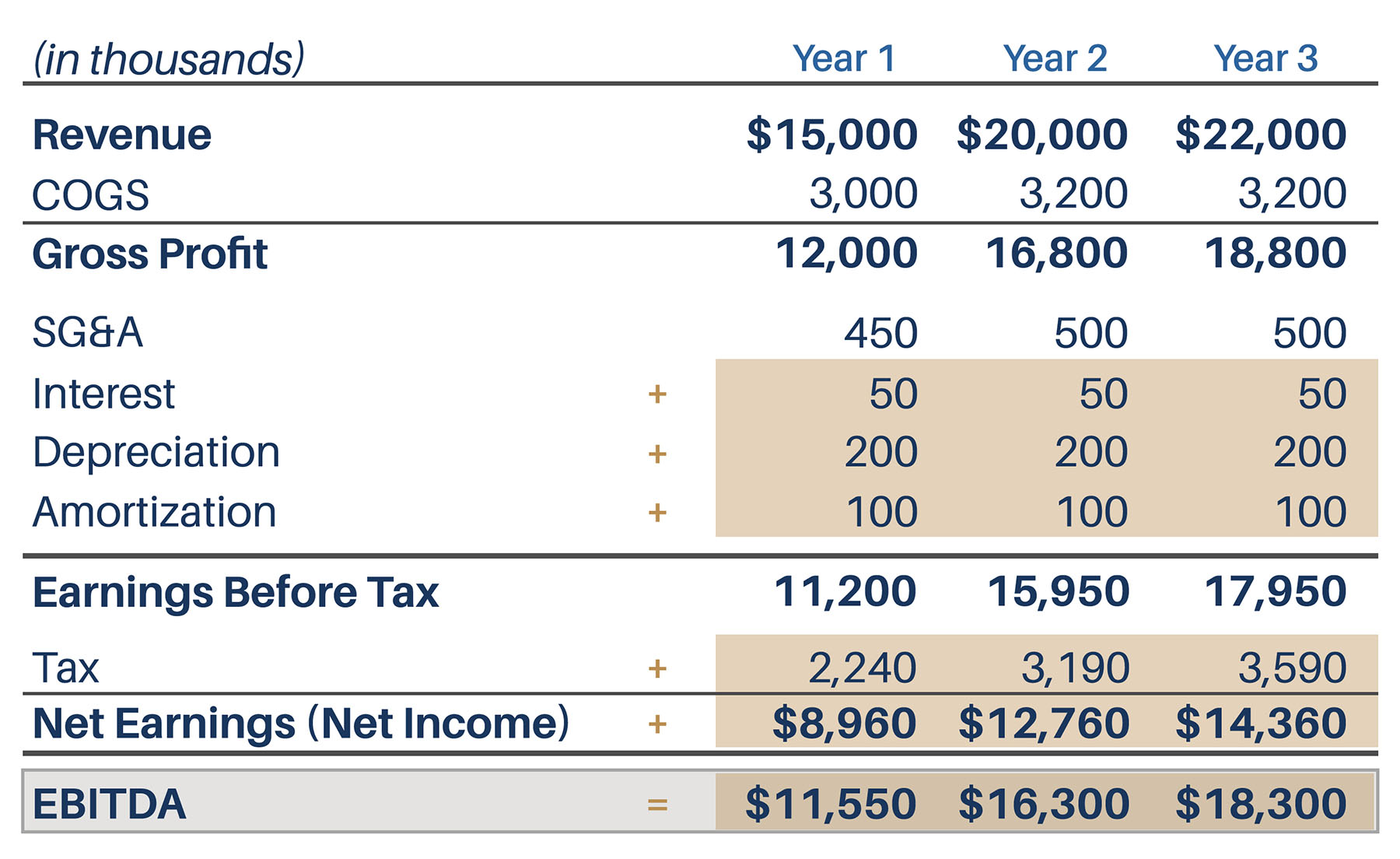

EBITDA stands for “Earnings Before Interest, Taxes, Depreciation and Amortization.” EBITDA is a metric used to evaluate a company’s operating performance. It can be seen as a proxy for cash flow from the entire company’s operations.

EBITDA = Net Income + Taxes + Interest Expense + Depreciation + Amortization

E = Earnings

B = Before

I = Interest

T = Tax

D = Depreciation

A = Amortization

Adjusted EBITDA Explained.

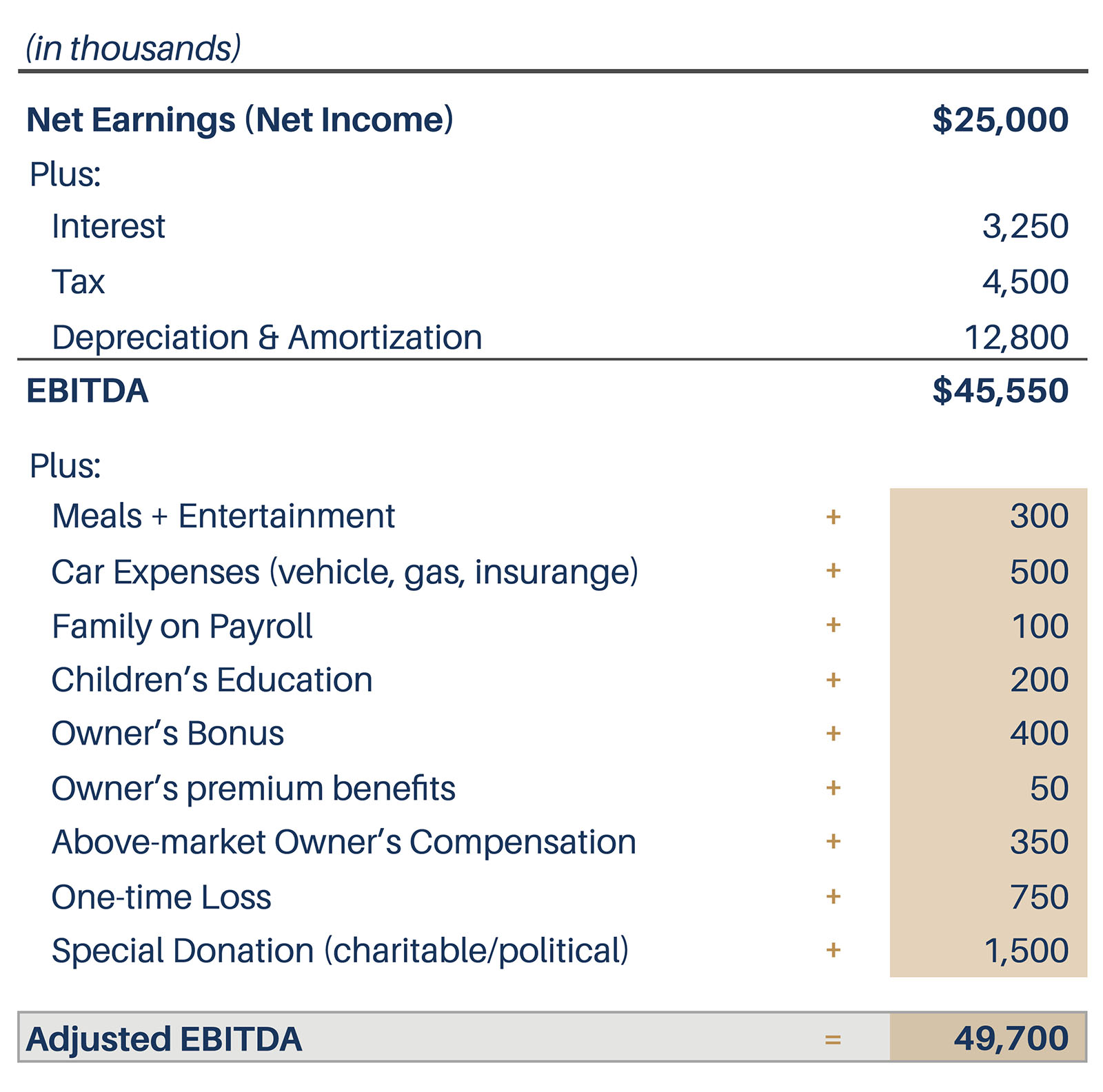

It is usual that the Company identifies additional expenses (“Adjustments”) to be included as part of EBITDA to better represent the true operating base of the business. Adjustments to EBITDA can vary widely between industry and company. The following items are commonly adjusted.

- Non-Operating Income

- Above-Market Owners’ Compensation (Base Salary, Bonus, Benefits)

- Owner’s Car Expenses (Vehicle, Gas, Tolls, Insurance, Maintenance)

- One-Time Gains or Losses

- Unrealized Gains or Losses

- Litigation Expenses

- Special Donations (Political or Charitable)

- Meals + Entertainment (Personal Meals or Trips)

- Family Members on Payroll

- Children’s Expenses

Adjusted EBITDA Example

An Example:

To calculate Adjusted EBITDA, we first calculate the unadjusted EBITDA. We start by taking net income and adding back interest, taxes, depreciation and amortization. Using an example income statement, we start with the net income of $25,000,000 and add back taxes, interest expense, and depreciation & amortization. The resulting EBITDA is now calculated at $45,550,000.

Next, we move to the adjusted EBITDA by identifying adjustments. In the example, we identify adjustments that total $4,150,000. Anything that is non-recurring, extraordinary, or personal in nature will be added back to arrive at what the true Free Cast Flow (FCF) of the business would be if the buyer were to own it. Added to EBITDA, the adjusted EBITDA has been calculated at $49,700,000, a significant difference between the net income of $25,000,000.

Why do Buyers look at EBITDA instead of Net Income?

Interest:

Interest is included in EBITDA as it depends on the financing structure of a company. Interest comes from the money the company has borrowed to fund business activities. Different companies have different capital structures, resulting in different interest expenses. Hence, it is easier to compare the relative performance of companies by adding back interest and removing the impact of capital structure on the business.

Taxes:

Taxes vary based on the region where the business is operating. Taxes are a function of tax rules, which are not part of assessing a management team’s performance. Thus, financial analysts prefer to add them back when comparing businesses.

Depreciation & Amortization:

Depreciation and Amortization (D&A) depend on the historical investments the company has made and not on the current operating performance of the business. Companies invest in long-term fixed assets (such as buildings or vehicles) that lose value due to wear and tear. The depreciation expense is based on a portion of the company’s tangible fixed assets deteriorating. The amortization expense is incurred if the asset is intangible. Intangible assets, such as patents, are amortized because they have a limited useful life before expiration (competitive protection). D&A is heavily influenced by assumptions regarding useful economic life, salvage value, and the depreciation method used. Because of this, analysts may find that operating income is different than what they think the number should be, and therefore D&A is backed out of the EBITDA.